The recent price action of EVAA Protocol is a textbook example of the crypto market’s dual personality. On one hand, you have the narrative: a promising DeFi lending platform on the burgeoning TON ecosystem, fresh off a $2.5 million funding round (as reported by TON DeFi lender EVAA Protocol raises $2.5 million in private token sale - theblock.co) from a roster of credible venture firms like Animoca Ventures and Polymorphic. On the other hand, you have the raw data, which paints a far more volatile and, frankly, more cautionary picture.

In the past week, the EVAA token has surged by an astonishing 250.72%. Yet, in the last 24 hours, it has dipped by 3.08%. The 24-hour chart looks less like a financial instrument and more like a seismograph reading during an earthquake. Trading volume is up 6.40% to over $62 million, suggesting intense activity, but the directional conviction is unclear. Is this the consolidation before the next leg up, or is it distribution from early insiders to a new wave of retail hope? The numbers, as seen on the EVAA Protocol Price: EVAA Live Price Chart, Market Cap & News Today - CoinGecko page, offer clues.

The Discrepancy in the Denominator

Let’s set aside the daily price fluctuations and focus on the structural mechanics of the EVAA token. This is where the real story lies. The protocol currently has a market capitalization of approximately $83 million. A respectable figure for a new project. However, its fully diluted valuation (FDV) sits at a staggering $627 million.

This isn't just a gap; it's a chasm. The discrepancy stems from the circulating supply. Of a total 50 million tokens, only 6.6 million are currently on the market. That’s about 13%—to be more exact, 13.2% of the total supply is what’s driving an $83 million valuation. The other 86.8% is sitting off-market, held by the team, investors, and the treasury, waiting to be unlocked over time.

Think of it like a real estate developer building a 100-unit luxury tower. They sell the first 13 units at an incredibly high price, perhaps to insiders and enthusiastic early buyers. They then declare that the entire building is worth 100 times that single-unit price. It’s a valuation that exists on paper, contingent on the fantasy that the remaining 87 units can also be sold at that same peak price when they eventually hit the market. It rarely, if ever, works out that way.

This low-float, high-FDV model is a classic mechanism for generating initial price velocity. With so few tokens available, even a moderate amount of buying pressure can send the price soaring, creating a powerful illusion of demand and value. I've looked at hundreds of these tokenomics models, and this level of disparity between circulating market cap and FDV is a significant red flag for retail participants who might be buying in at the top of this initial, supply-constrained pump. The most critical question isn't what the price is today. The question is: what is the vesting schedule for the other 43.4 million tokens, and who, precisely, will be there to absorb that supply when it begins to unlock?

Gauging the Market's Temperature

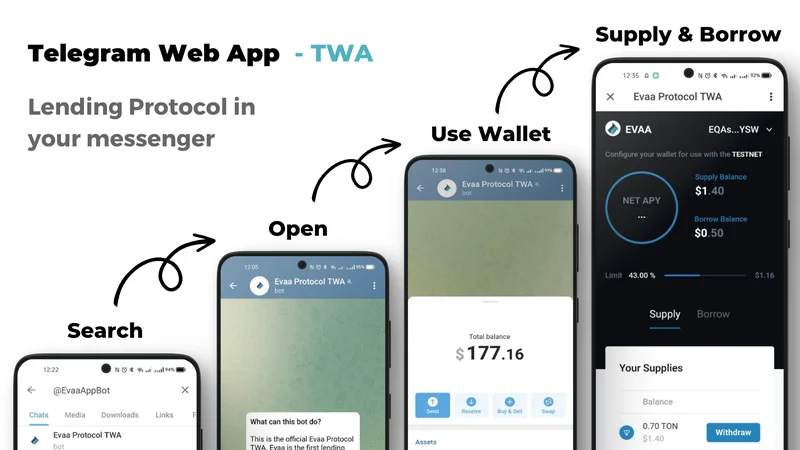

The narrative driving this initial momentum is compelling. EVAA is positioning itself as a core financial primitive on TON (The Open Network), an ecosystem with deep ties to the massive user base of the Telegram messaging app. Partnerships with the TON Foundation and Notcoin lend it significant credibility. The protocol offers a standard suite of DeFi services—lending, borrowing, and leveraged staking—which are essential components for any mature blockchain environment.

Community sentiment, at least on the surface, appears to reflect this optimism. CoinGecko reports that 62% of its users have a "bullish" outlook on EVAA. But we must treat this as the qualitative, anecdotal data set that it is. This figure represents the feelings of a self-selecting group of already-engaged crypto users, not the broader market. It’s a measure of current holder enthusiasm, not a predictive indicator of the market's capacity to absorb future supply inflation.

What is the source of this bullishness? Is it a deep, fundamental analysis of EVAA’s lending protocol, its fee structure, and its risk parameters? Or is it a reaction to a number that has gone up by 250% in a week? The data on trading volume versus price action suggests a significant amount of churn. While the project has secured a respectable $2.5 million in a private sale (a standard seed-stage amount), that capital injection is dwarfed by the daily trading volume and the paper valuation. It raises another uncomfortable question: how much of the current market activity is driven by the protocol's utility versus pure, unadulterated speculation on a low-float asset? Details on the token's utility and governance rights are present, but their current value seems entirely disconnected from the speculative fervor.

A Calculation of Hype

My analysis suggests that EVAA Protocol is a textbook case of a venture-backed token launch where the valuation is a function of engineered scarcity, not demonstrated utility. The $627 million fully diluted valuation is not a reflection of the protocol's current cash flows or total value locked (details on which are conspicuously difficult to parse). It is a speculative projection based on an artificially constrained supply.

The real test for EVAA will not come this week or next. It will come in the months ahead, as the token unlocks for early investors and the team begin. At that point, the market will have to absorb a steady stream of new supply. If the protocol can grow its user base and utility at a rate that outpaces this inflation, the valuation might hold. But history shows that this is an incredibly difficult feat. For now, the price of EVAA is not a measure of its fundamental value; it is a calculation of hype.