Nvidia’s stock (NVDA) is a mathematical marvel. As of this morning, its market capitalization sits at $4.59 trillion. The stock has climbed over 58% in the past year—to be more exact, 58.97% over the past twelve months, with a 36.61% gain in 2025 alone. Numbers like these don't just happen; they are the output of a formula that assumes near-perfect execution and boundless growth. The market has priced Nvidia not just as a dominant company, but as a foundational utility for the future of global technology.

This valuation is predicated on the idea that every government and major corporation on the planet will be a customer, writing massive checks for the foreseeable future. That assumption is now being tested not by a competitor, but by a single signature—or lack thereof—from the U.S. Commerce Secretary. A multibillion-dollar deal to supply the United Arab Emirates with advanced AI chips, announced with presidential fanfare back in May, is now gathering dust. The pipeline is clogged, and the market doesn’t seem to have priced in the blockage.

The Geopolitical Friction Coefficient

The official narrative from the White House is a carefully worded statement about diligence. Spokesman Kush Desai assures us that AI Czar David Sacks and Commerce Secretary Howard Lutnick are "working diligently to get deals done." Yet, the deal remains stalled. The friction appears to be twofold: Lutnick is reportedly withholding approval until the UAE commits to certain U.S. investments, and there are stated security concerns about the UAE’s relationship with China.

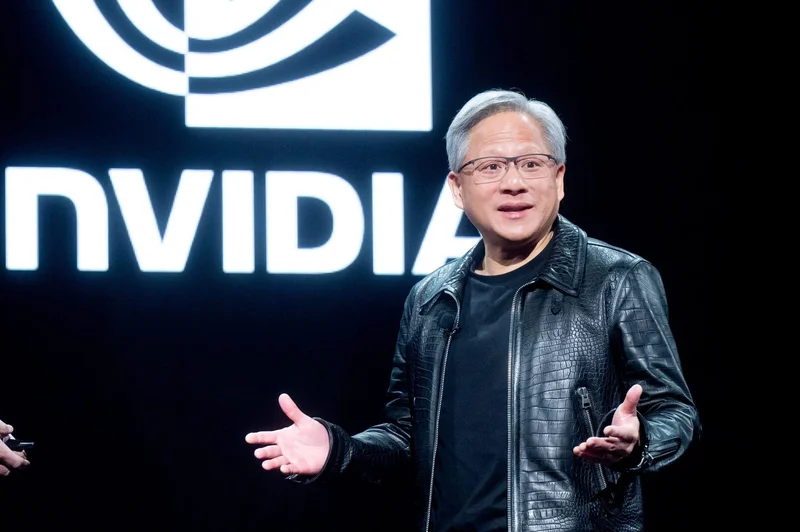

This is where the clean, predictable world of financial modeling collides with the messy, unpredictable reality of geopolitics. For the CEO of Nvidia, Jensen Huang, this must be intensely frustrating. His company builds the most powerful computational engines in history, yet their delivery can be halted by a subjective assessment of diplomatic relationships. Sources say Nvidia executives are privately agitated, even as the company’s official spokesperson maintains a posture of unwavering support for the administration’s policies (Nvidia CEO Jensen Huang Reportedly Frustrated As Trump's Commerce Secretary Slows UAE Chips Deal Over China Link - Yahoo Finance). And this is the part of the report that I find genuinely puzzling: the public-private dissonance. I've analyzed hundreds of corporate statements, and this specific pattern—public deference combined with private frustration—is a reliable indicator of significant, material drag on operations. It signals a problem that can't be solved with engineering or marketing.

What exactly is the hold-up? The deal was framed as part of a much larger package of bilateral agreements (totaling over $200 billion), which makes the delay on this specific, high-profile component even more conspicuous. If the goal was to counter China's AI ambitions, as President Trump stated in May, then delaying the deployment of U.S. technology seems counterintuitive. Is this a genuine, calculated security review, or is it a symptom of bureaucratic friction within the administration? The reports of some officials being "baffled" by the delay suggest the latter.

This situation is like building the world’s fastest race car and then being told it can only be driven on unpaved roads. Nvidia’s entire business model is built on speed—speed of innovation, speed of production, and speed of deployment. Geopolitical gatekeeping introduces a variable that’s impossible to model accurately. How do you quantify the risk of a sudden policy shift or a stalled export license in a discounted cash flow analysis? You can’t, not really. It becomes a qualitative risk factor that, in my view, is being grossly underestimated by investors chasing the momentum of Nvidia stock.

An Unpriced Risk Premium

The market's reaction—or lack thereof—is the most telling part of this entire affair. A multibillion-dollar deal is frozen indefinitely, a key growth market is in jeopardy, and the stock barely registers the turbulence. This suggests an investor base that is either unaware of the risk or simply believes Nvidia is too powerful to be constrained by government action. This is a dangerous assumption.

The very premise of Nvidia's continued ascent rests on its ability to sell its most advanced systems globally. The UAE deal wasn't just another sale; it was a strategic beachhead in a region pouring sovereign wealth into AI infrastructure. It was meant to be a showcase for American technological supremacy. Instead, it’s become a case study in how that supremacy can be self-sabotaged. The image is no longer one of sleek, humming supercomputers being installed in a desert data center, but of crates of H100s sitting in a warehouse, waiting for a bureaucrat's approval.

The core question investors should be asking is this: Is the UAE an outlier, or is it a precedent? If the U.S. is willing to stall a deal with a strategic partner over security and investment linkages, what happens when Nvidia attempts to expand into other regions with even more complex ties to China? Every nation in Southeast Asia, Africa, and South America presents a similar, if not more complicated, geopolitical calculus. If every major deal requires a bespoke diplomatic negotiation, Nvidia’s growth trajectory is no longer a smooth exponential curve. It’s a jagged, unpredictable line subject to the whims of policymakers.

The current valuation of Nvidia leaves no room for such errors or delays. It demands flawless, frictionless expansion. What we're witnessing with the UAE is the introduction of friction. It's a new, unpriced variable in the equation, and the longer the deal remains stalled, the more this variable should weigh on the minds of anyone holding the stock.

The Numbers Assume a World That No Longer Exists

My analysis isn't about whether Nvidia makes incredible technology; it does. It's about whether the company's stock price accurately reflects the world it operates in. A $4.59 trillion valuation implies a future free of significant geopolitical barriers. The stalled UAE deal is the most significant data point yet that this assumption is flawed. The market is pricing in the upside of technological dominance without adequately pricing in the downside of the political world in which that technology must be sold. That is a fundamental discrepancy, and discrepancies like that don't last forever.