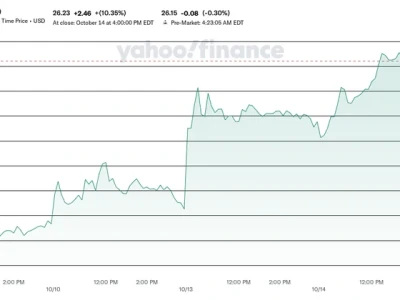

So let’s get this straight. One day, the market is screaming bloody murder because of some tariff tweet, and the Nasdaq-100 ETF (QQQ) tanks 3.5%. The screens glow red, your stomach drops, and you think, "This is it. The big one." Then, over the weekend, the same guy says, "Just kidding!" and everything rips higher. And we're all supposed to pretend this is a normal, functioning system for allocating capital.

Give me a break.

Now, we see a headline: Dynamic Advisor Solutions Dumps 26K QQQ Shares Worth $15 Million. The official story, the one spoon-fed to us in the press releases, is that it's just some light housekeeping. "Likely simply to take some earnings," the sanitized 'Foolish take' says. "Some rebalancing is required as a matter of course."

This is just standard portfolio management. No, 'standard' isn't right—it's standard cover. This is the corporate-speak equivalent of seeing someone sprinting out of a burning building and having them tell you they’re just "proactively seeking a temperature-neutral environment." They still hold a ton of QQQ, sure, but peeling off 26,000 shares isn’t just trimming the hedges. It’s testing the escape hatch. Are they seeing something they're not telling us? Or are they just as confused as the rest of us and just wanted to cash in some chips before the whole casino collapses?

The Two-Faced Experts

The best part of this whole circus is listening to the so-called experts. It’s a masterclass in saying absolutely nothing while sounding profound. On one hand, you have the Wall Street megaphones at UBS and Goldman Sachs screaming that "the bull market is intact." They’re bumping up their S&P 500 targets to numbers that sound like they were pulled from a hat, implying tech has nowhere to go but up.

Then, you get the killjoys from the Bank of England whispering that AI-heavy tech stocks—the very engine of QQQ—look "particularly" overvalued and risk a "sudden correction." You have guys like Anthony Saglimbene from Ameriprise admitting that investors are getting "concerned about… the payback" on all this AI spending. It’s like watching two weather forecasters on the same channel, one promising a sunny day and the other warning of a hurricane, and they both just smile and collect their paychecks. Which one is it? Is my 401(k) on a rocket ship or the Hindenburg? The fact that nobody can give a straight answer tells you everything you need to know.

This whole market feels like a game of musical chairs being played on the deck of a ship that’s listing hard to one side. The music is the AI hype and whispers of Fed rate cuts. As long as it’s playing, everyone keeps dancing, pretending not to notice the tilt. But you see guys like Dynamic Advisor Solutions quietly inching closer to the lifeboats. They're not jumping yet, but they're making sure they have a clear path. You see it in the gold price, too, hitting a record high of over $4,100 an ounce. That ain't a sign of confidence, folks. People don't hoard shiny rocks when they think the economy is booming.

And don't even get me started on the leveraged ETFs. Traders piled into TQQQ, the 3x leveraged version of QQQ, and made a killing with a 37% gain this year. You’d think they’d be celebrating, right? Wrong. A record $7 billion flowed out of TQQQ in September alone. They’re cashing out and running for the hills. They rode the wave, and now they hear the roar of it crashing on the shore. They know this kind of volatility is a double-edged sword, and after the bloodbath of 2022, they’re not sticking around to see what happens next. It’s the ultimate tell: the people with the most skin in the game are taking their money off the table. Meanwhile, the mainstream analysts are still telling you to buy, buy, buy. It’s just…

So What Are We Supposed to Do?

Look, I get it. QQQ tracks the 100 biggest, baddest tech companies on the planet. Apple, Microsoft, Nvidia. These are the titans that built the modern world. Betting against them feels like betting against progress itself. And offcourse, if you held on, you've done incredibly well, outperforming the S&P 500 by a healthy margin. The numbers don't lie.

But the narrative is a lie. The story they sell us—of a rational market driven by fundamentals and clear-eyed analysis—is a complete fiction. It’s a chaotic mess driven by algorithms, presidential tweets, and pure, unadulterated herd panic. The price targets from TipRanks and TS2.tech are just guesses dressed up in a suit and tie. They say QQQ could hit $662, a nice 10% upside. They could be right. Or a trade war spat could send it tumbling back to $550 before you can even log into your brokerage account.

Maybe I’m the crazy one. Maybe it really is as simple as "the bull market is intact" and we should all just shut up and enjoy the ride. But when I see billions flowing out of leveraged funds while they’re at their peak, and I see central banks using words like "frothy," and I see institutional players quietly selling off multi-million dollar chunks, I don’t feel confident. I feel like I'm the only one at the party who can smell smoke.

The truth is, nobody knows anything. They're all just placing their bets and hoping for the best. The only difference between them and a guy at a Vegas craps table is that they use more complicated math to justify their superstitions.