So, everyone with a Robinhood account is suddenly a geopolitical genius because a uranium stock popped. Give me a break.

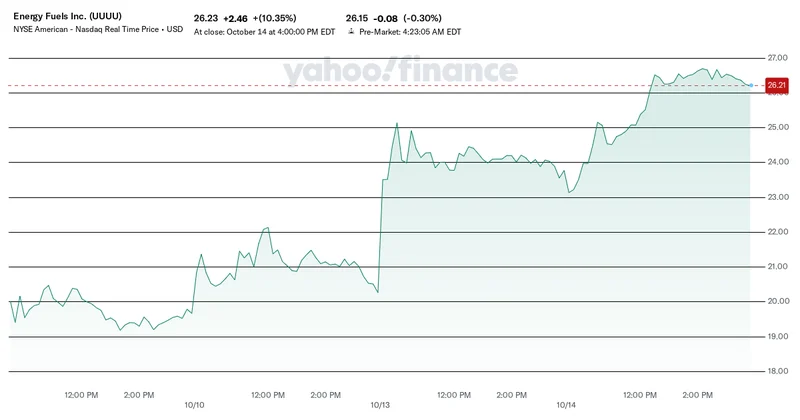

The ticker is UUUU, Energy Fuels Inc., and it shot up over 23% in a week (Energy Fuels (UUUU) Hits a Fresh High Amid the Escalating Trade War - Yahoo Finance). The reason? China, in its infinite subtlety, decided to rattle its saber about rare earth exports right before Presidents Trump and Xi were scheduled for a little chat. The markets, ever the rational entity, freaked out and piled into the one American company that looks like a flag-waving solution to our critical mineral problem.

I can just picture the scene: some 28-year-old trader, still wiping the avocado toast from his chin, sees the alert on his terminal. The Pavlovian bell rings. China... bad. Domestic production... good. He slams the buy button on UUUU so hard he almost spills his cold brew. And just like that, a stock reaches an all-time high. It's a beautiful, stupid dance, and we see it every single time.

The Geopolitical Puppet Show

Let’s be brutally honest here. This whole China export curb thing is political theater. It’s the international equivalent of a couple threatening to break up in a crowded restaurant just to see who blinks first. China flexes its supply chain muscle, the U.S. gets a jolt of nationalistic panic, and a few well-positioned stocks go to the moon. Everyone acts like this is some 4D chess move, but it's the same playbook they've run for years, and honestly... it's getting boring.

The surge in Energy Fuels is a pure, unadulterated headline trade. It's not based on a sudden discovery of a mountain of unobtanium in Utah. It's a bet on fear. And fear is a powerful, but incredibly fickle, motivator. UUUU is a company that digs up ten of the fifty minerals deemed "critical" for all the tech we can't live without. With the Trump administration also making noise about cutting our reliance on Russian nuclear fuel, the company looks like a sure thing. A patriotic, all-American home run.

This is the market acting like a flock of pigeons in a city park. One person throws a single french fry, and a hundred birds descend into a chaotic, feathered vortex, all fighting for that one greasy scrap of potato. They don't see the guy a few feet away with a whole bag of breadcrumbs. Right now, UUUU is that french fry. It's the most obvious, immediate reaction to the "China threat," and everyone wants a piece. But is it the meal?

Chasing Yesterday's Gold Rush

Okay, I'll give the bulls their due. The case for Energy Fuels isn't complete nonsense. We do need a secure supply chain for uranium, for vanadium, for the rare earths that power our phones and electric cars. Relying on geopolitical rivals for the building blocks of your entire technological society is, to put it mildly, a catastrophically dumb strategy. So, a US-based company that can pull this stuff out of American soil? Offcourse it has value.

So it's a solid play, right? A no-brainer. No, 'no-brainer' is what gets you into trouble—it's a trap. Investing in a mining company, even a strategically important one, is a bet on the past. It’s a bet on digging, crushing, and processing rocks. It’s a brutal, capital-intensive business that is subject to the whims of commodity prices, environmental regulations, and the exact kind of political drama we just witnessed.

You’re betting that the current political climate holds. What happens when the Trump-Xi talks go surprisingly well? What happens when a new, cheaper processing technology is developed in Australia? What happens when the next administration decides that Russian uranium is suddenly fine again? The entire investment thesis for UUUU can be shattered by a single tweet or a backroom deal. Are we really supposed to believe that our entire economic future depends on hoping we dig up shiny rocks faster and more efficiently than a country with a billion people and a centrally planned economy? It feels... fragile. It feels like we're fighting yesterday's war with yesterday's tools.

The Real Game is Elsewhere

This is where I get off the hype train. While everyone is scrambling to own a piece of the dirt UUUU is digging up, they're missing the bigger picture. The real, paradigm-shifting, world-altering revolution isn’t in the physical materials; it’s in the intelligence we’re building on top of them.

I'm talking about AI.

Yeah, I know, "AI" is the buzzword of the decade, and every company is slapping it on their slide decks. But look past the hype. Betting on Energy Fuels is a bet on the ingredients. Betting on the right AI companies is a bet on the recipe—the thing that actually creates value. One is a finite resource you pull from the ground. The other is an infinite resource you create from data and code.

Why do I say AI stocks might have less downside risk? It sounds crazy, I know. But an AI platform's success isn't tied to a single mine in Utah or a trade spat with China. It's a decentralized, software-based revolution that is embedding itself into every corner of the economy. The demand for smarter logistics, better drug discovery, and more efficient everything ain't going away, regardless of who is in the White House. The downside for UUUU is a peace treaty. The downside for AI is… what, exactly? That humanity decides it wants to be dumber and slower?

Then again, maybe I'm the crazy one. Maybe we’ll all be huddled in the dark, bartering chunks of vanadium for clean water while some god-like AI in a server farm laughs at our primitive struggles. But I have to place my bets somewhere. And I'd rather bet on the architects of the future than the guys selling the bricks.

It's a Sucker's Bet

Let's call this UUUU surge what it is: a short-term sugar high driven by fear and headlines. It's a reactive, emotional trade that mistakes political theater for a fundamental shift. The real money, the real future, isn't in fighting over the scraps of the old world. It's in building the new one. Chasing these shiny, headline-grabbing commodity plays is how you end up holding the bag when the news cycle moves on. It’s gambling, not investing. And it’s a game I’m not willing to play.