So, let's get this straight. The Dow closes down, but the Nasdaq and S&P 500 are up. Bank of America and Morgan Stanley are apparently printing money, with reports like Dow Jones Futures Rise; AI Chip Giant, Bank Of America, Morgan Stanley Flash Buy Signals On Earnings convincing every suit on Wall Street that the economy is just humming along. Meanwhile, the U.S. government has a giant "Closed" sign hanging on the door for the third week running, and the President is threatening China with... a cooking oil embargo.

I had to read that twice. A cooking oil embargo.

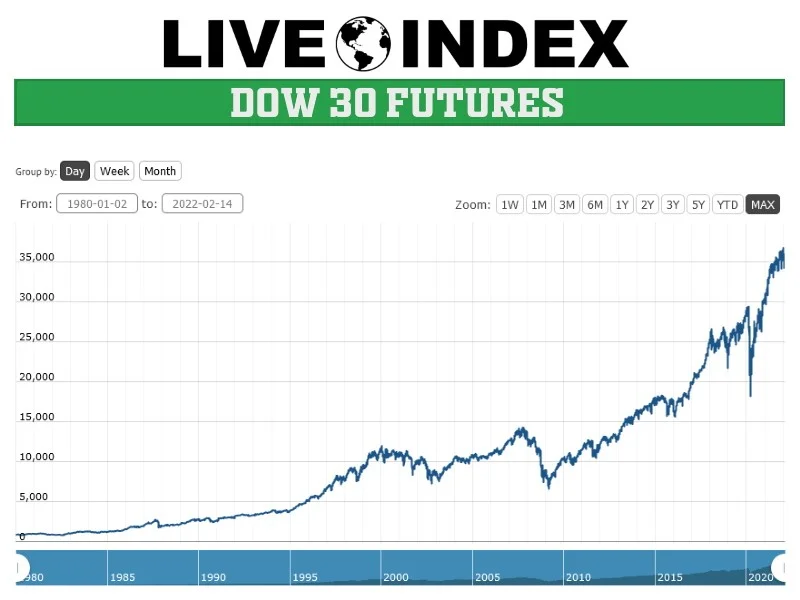

You watch the ticker at 4 PM, a nauseating digital pulse of red and green, and you realize none of it means anything anymore. It’s a fever dream cooked up by algorithms and politicians who are fundamentally disconnected from reality.

The Economy is Great, If You Don't Look Too Closely

The talking heads are having a field day. Sam Stovall over at CFRA sees blowout bank earnings—part of the reason the S&P 500 closes higher after another volatile session, aided by strong bank earnings—and declares it "an indication that the economy remains strong." Strong? How the hell would we know? The agencies that actually report on the economy—the Bureau of Labor Statistics, the Census Bureau—are dark because of the government shutdown. I tried to look up a simple import-export stat the other day for another piece, and the website literally says to come back later. We're flying a 747 with the cockpit windows painted black, and the analysts are telling us what a beautiful day it is outside.

This whole market feels like a patient on a morphine drip. The vital signs on the monitor look stable, even cheerful. Look! Walmart’s up 2% and hit a 52-week high because they’re partnering with OpenAI. Now you can have a chatbot order your groceries for you. Fantastic. What a win, as the folks at Citi called it. Never mind that the country’s basic infrastructure is being held hostage. At least my AI can buy me more popcorn to watch the collapse.

It’s all a grand distraction. A magic trick. Don’t look at the shuttered federal buildings or the geopolitical game of chicken, look at the shiny object! Look at Papa John’s soaring 11% on a takeover rumor! This isn't investing; it's high-stakes bingo played with our 401(k)s. And I'm starting to think the house ain't the only one that's cheating.

A Circus Run by Pathological Liars

Then you have the White House. Treasury Secretary Scott Bessent had the gall to stand up and say, "We won’t negotiate because the stock market is going down." Let me translate that for you from PR-speak into English: "We are watching the stock market so closely our eyes are bleeding, and we’re terrified, but admitting that would show weakness." It’s such a transparently false statement it’s almost insulting.

And in the same breath, he talks about pressuring defense companies to cut back on share buybacks. The result? Lockheed Martin and Northrop Grumman immediately take a nosedive. This is a bad idea. No, 'bad' doesn't cover it—this is a five-alarm dumpster fire of market intervention. One minute they're "free market capitalists," the next they're setting price floors and telling private companies how to spend their cash. Which is it? Do they have any core beliefs beyond whatever gets them a good headline on Fox News?

The most baffling part is that some corners of the market are eating it up. The Russell 2000 small-cap index is on track for its best week of the year. Why? My best guess is that investors are so tired of getting whip-sawed by Trump’s latest 3 AM tweet about tariffs that they’re fleeing to smaller companies that maybe, just maybe, he hasn’t heard of yet. It’s a strategy, I guess. It ain't a good one. They expect us to just keep buying the dip, and offcourse the system keeps chugging along... for now.

But what happens when the morphine wears off? What happens when the sugar high from a few good earnings reports fades and we’re left with the reality of a deadlocked government and a trade war being fought with kitchen condiments? Then again, maybe I'm the crazy one for expecting logic.

So We're All Just Pretending, Then?

At the end of the day, the VIX, the so-called "fear index," closed around 20. That's not panic. That's... complacency. It's the dull, sedated acceptance of a world that no longer makes a lick of sense. The numbers go up, the numbers go down, and none of it feels tethered to the ground we're standing on. We're living in a spreadsheet, and the people in charge are just changing the formulas whenever they feel like it. This isn't a market. It's a reality TV show, and we're all just unwilling contestants.