The Unspoken Variable in NV Energy's Rate Hike

In the sterile environment of a regulatory hearing room, the air is thick with the low murmur of concerned citizens and the rustle of legal documents. This isn't a courtroom drama; it's the front line of a complex financial and legal battle unfolding in Nevada. At the center is NV Energy, the state's primary utility, and a newly approved rate structure so unusual that it has drawn the formal opposition of the Nevada Attorney General’s Bureau of Consumer Protection (BCP).

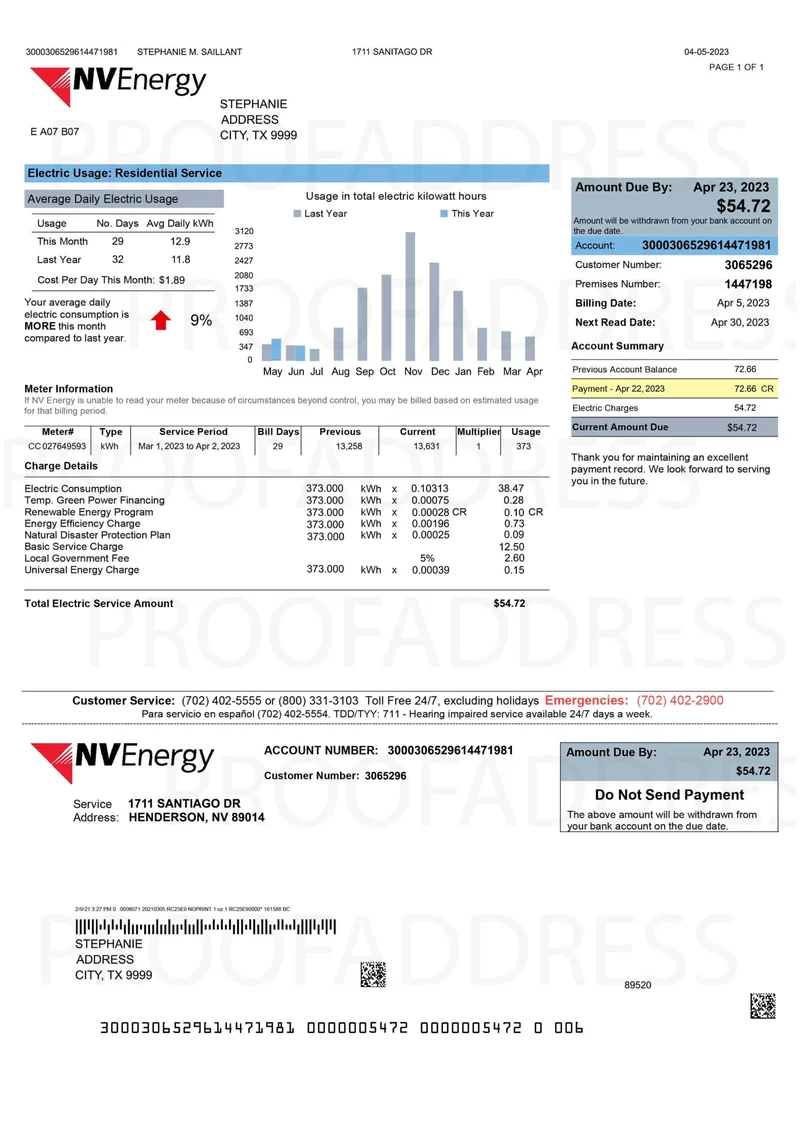

The utility's proposal, part of a broader $119 million rate hike, introduces something called a "peak demand charge" for residential customers. The mechanics are simple, yet the implications are profound. Each day, the utility will identify the single 15-minute window of a household's highest electricity consumption. That peak usage, measured in kilowatts, will then be multiplied by a new, separate rate. This isn't about how much energy you use over a month; it's about your single moment of maximum draw.

NV Energy presents this as a modernizing step toward fairness. But as we unpack the numbers and the statutes, a different picture emerges. The proposal appears to be a solution meticulously engineered to target a specific subset of customers while resting on a shaky legal and logical foundation. The public response, described by the BCP as "vehemently negative, confounding and filled with fear of rate-shock," is more than just consumer anxiety. It’s a rational reaction to a policy that introduces a volatile and unpredictable variable into every household budget.

A Legally Dubious Calculation

The first and most glaring issue with the peak demand charge is its apparent conflict with Nevada state law. The BCP’s petition for reconsideration is not based on esoteric regulatory interpretation; it's a direct citation of statute. Nevada law explicitly prohibits the Public Utilities Commission (PUC) from approving a rate for residential customers "which is based on the time of day" unless the customer affirmatively chooses it. NV Energy peak demand charge, tweak to net metering, violate state law, say experts • Nevada Current

This is where the utility's argument begins to unravel. The PUC, in its own order approving the charge, stated the fee “‘varies based on the time during which the electricity is used.” It’s a direct contradiction. How can a regulator approve a mandatory charge that its own justification confirms is the very type of charge prohibited by law for non-consenting customers?

NV Energy and the PUC’s rationale hinges on the "uniqueness of the circumstances in Nevada." I've looked at hundreds of these filings, and this particular justification is unusually vague. A unique regulatory framework is not a blank check to ignore specific statutory prohibitions. In fact, no other investor-owned utility in the entire United States mandates a peak demand charge for residential customers. This makes Nevada an outlier—a statistical deviation of 100%. When a regulated monopoly proposes something no one else is doing, the burden of proof should be extraordinarily high. Instead, the justification is opaque.

This brings us to the core question: What specific, data-driven "uniqueness" warrants a rate structure that is not only unprecedented but also appears to be illegal on its face? Is this a genuine effort to manage grid load, or is it a financial instrument designed for another purpose entirely?

The Rooftop Solar Equation

The data suggests the latter. The group most directly and negatively impacted by this change is the roughly 10% of NV Energy customers with rooftop solar systems. For these households, the peak demand charge acts as a financial penalty that systematically undermines the economic premise of their investment.

NV Energy’s narrative is that solar customers are being subsidized by the other 90% of ratepayers to the tune of $50 million per year. The demand charge, they argue, is about correcting this imbalance. An average solar customer, the utility estimates, will see their bill increase by about $12 a month. Non-solar customers, conversely, might see a slight decrease. On the surface, it’s a simple redistribution.

But this framing is misleading. A solar household’s value to the grid isn’t just the energy it consumes; it’s also the energy it produces and exports, particularly during sunny afternoons when system-wide demand is high. The peak demand charge, however, is a one-way street. It penalizes a solar customer for a brief moment of high consumption (say, charging an EV after sunset) but ignores the value of the clean energy they supplied to the grid all afternoon. As one solar user, Michael Cook, pointedly stated, "This one-size-fits-all metric ignores total generation and exports, punishing net producers like me."

This is like a bank offering a high-yield savings account but also introducing a new, unpredictable "peak withdrawal fee" that could erase the interest earned. It fundamentally alters the risk-reward calculation. The proposed change to net metering in Northern Nevada, which shifts from monthly to 15-minute credit calculations for new solar customers, further reinforces this strategy. It’s a clear, systemic disincentive for future solar investment. The utility is effectively increasing the payback period for a multi-thousand-dollar capital asset (the solar panels) via a regulatory change.

This isn’t happening in a vacuum. The utility recently had to address overcharging more than 60,000 customers. Its request to FERC for a penalty-free exit window for projects in its interconnection queue was denied for being too broad—affecting about 69 projects totaling 23.1 GW, or to be more exact, 23,109 MW. FERC rejects NV Energy plan to allow free exit from interconnection study. These are not signs of a smoothly operating entity. They are data points suggesting a pattern of widespread operational and regulatory friction.

The peak demand charge feels less like a fair-minded grid management tool and more like a targeted financial weapon against a competing source of energy generation—distributed solar. The utility is using its monopoly power to change the rules of the game for homeowners who have already placed their bets.

A Solution in Search of a Problem

My analysis suggests this isn't about grid stability or ratepayer fairness in the way it's being marketed. The legal challenges are substantial, the economic justification is thin, and the implementation is unprecedented. NV Energy is proposing a complex, legally questionable, and highly targeted rate structure to address the "problem" of rooftop solar subsidies. Yet, this "problem" is a direct consequence of a state policy designed to encourage clean energy adoption. The utility is attempting to use a convoluted billing mechanism to counteract a legislative goal. It’s a strategic gambit, wrapped in the language of engineering, that introduces massive uncertainty for consumers and undermines the distributed energy market. The numbers, and the law, simply don't support it.