The Anatomy of a $12 Billion Wager on Biological Delivery

On a Sunday, when markets are supposed to be sleeping, the wire lit up with the kind of news that makes analysts spill their coffee. Novartis announced its intention to acquire Avidity Biosciences for $12 billion. It’s the kind of headline number that grabs your attention, but the real story, as always, is buried in the details of the deal structure and the specific technology Novartis is paying for.

The surface-level math is straightforward. Novartis is offering $72 per share for Avidity, a 46% premium over its Friday closing price. To be more exact, it’s a 46.5% premium on a $49.15 close. In a market that’s seen a recent surge in biotech M&A, a premium like that isn't entirely shocking, but it still demands justification. This isn’t just a big deal; it’s the second-largest of the year and one of Novartis’s most significant outlays since its buyouts of AveXis and The Medicines Company. This isn’t a tentative dip of the toe; it’s a full-on cannonball into the deep end of the RNA therapeutics pool.

But this is where I find the structure of the deal genuinely interesting. It’s not a clean, simple buyout. Avidity is concurrently spinning off its early-stage cardiovascular assets into a new, publicly traded entity. Existing Avidity stockholders will get a piece of that new company, a sort of parting gift or, more accurately, a retained lottery ticket on a completely different set of clinical outcomes. This isn't just a footnote; it's a critical component of the deal's architecture. It allows Novartis to surgically excise the assets it truly wants—the neuromuscular pipeline—without paying for the speculative, early-stage work it doesn't.

This move effectively de-risks the acquisition for Novartis, focusing the $12 billion price tag squarely on the neuromuscular platform. For Avidity shareholders, it’s a clever way to realize a massive, immediate gain while holding onto future upside. But it begs a critical question that the press release doesn't answer: How was the valuation of this new, unnamed cardiovascular company determined, and does its value effectively lower the true premium Novartis is paying for the assets it's keeping?

A Bet on the Mailman, Not Just the Mail

To understand why Novartis is willing to write a 10-figure check, you have to look past the three specific drugs in Avidity’s late-stage pipeline. The real prize here isn’t the mail; it’s the mailman. Avidity’s core technology is a platform for delivering RNA-based medicines into hard-to-reach muscle tissue. For years, RNA therapeutics have been like brilliant messages that could only be delivered to one address: the liver. Avidity’s Antibody Oligonucleotide Conjugates (AOCs) are the specialized courier service that can finally get those messages into muscle cells. Novartis isn't just buying three potential blockbuster drugs; it's buying the delivery system that could unlock an entire class of treatments for dozens of devastating diseases.

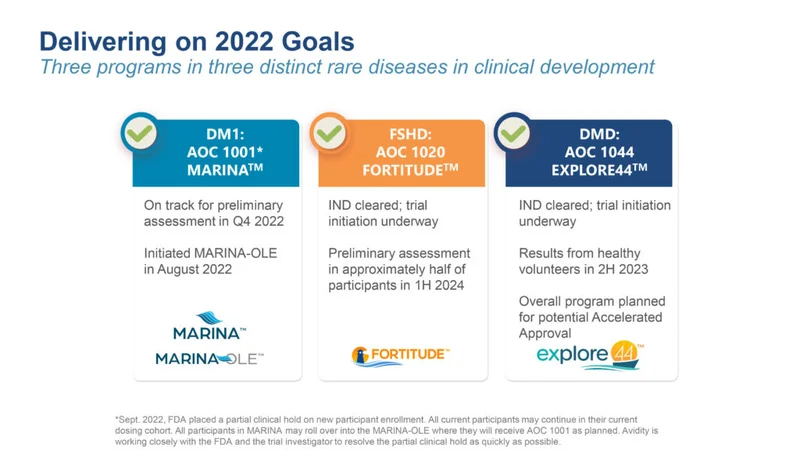

The three lead programs—for Duchenne muscular dystrophy, facioscapulohumeral muscular dystrophy, and myotonic dystrophy type 1—are the immediate justification for the price tag. These are all progressive neuromuscular conditions with enormous unmet medical need (and, consequently, significant pricing power). With Avidity projecting its first approval submission in early 2026 and two other pivotal trial readouts next year, the timeline to potential revenue is tantalizingly close for a biotech acquisition.

This is where the risk calculus comes in. Novartis is paying for a platform that has produced three promising candidates. But what happens if one of those key trials, expected in the second quarter of next year, fails? Does the entire platform's valuation take a hit, or is the delivery technology itself considered validated enough to survive a stumble by one of its lead products? The market for RNA stocks is notoriously volatile, and a clinical failure could have an outsized impact on sentiment. Novartis is betting that the AOC platform is robust enough to generate future winners even if one of the current front-runners falters. It’s a bet on the methodology, not just the single experiment.

This acquisition fits perfectly, almost too perfectly, into Novartis’s existing strategy. They already have a multi-billion-dollar neuromuscular franchise built on the back of the AveXis acquisition and its gene therapy for spinal muscular atrophy. They know the doctors, the patient groups, and the reimbursement landscape. Dropping Avidity’s pipeline into this existing commercial infrastructure is like adding a high-performance engine to an already-built race car. It’s a move that signals an intention to dominate this specific therapeutic area for the next decade. The question is whether the engine will run as smoothly as the schematics promise.

A Calculated Premium for a Strategic Key

When you strip away the corporate statements about "synergies" and "pioneering platforms," this deal comes down to a single, cold calculation. Novartis has identified a technological bottleneck in a field it wants to own—delivering RNA drugs to muscle—and has decided to pay a premium to acquire the company that holds a potential key. The $12 billion price tag, steep as it is, isn't for what Avidity Biosciences is today. It’s for what its AOC platform could enable for Novartis tomorrow.

The 46% premium isn’t just a reflection of three late-stage assets; it's the price of admission to a new technological paradigm. It's the cost of buying, rather than building, a decade of specialized research and development. The clever spin-off of the cardiovascular assets is the tell; it shows this wasn't a desperate, emotional grab for growth but a financially sophisticated move to acquire a specific strategic capability. This is a chess move, not a coin flip, and Novartis is betting that owning this one key piece will unlock a much larger board.