Forget the iPhone. This Week's Most Important Economic Signal Comes From Your Trash Can.

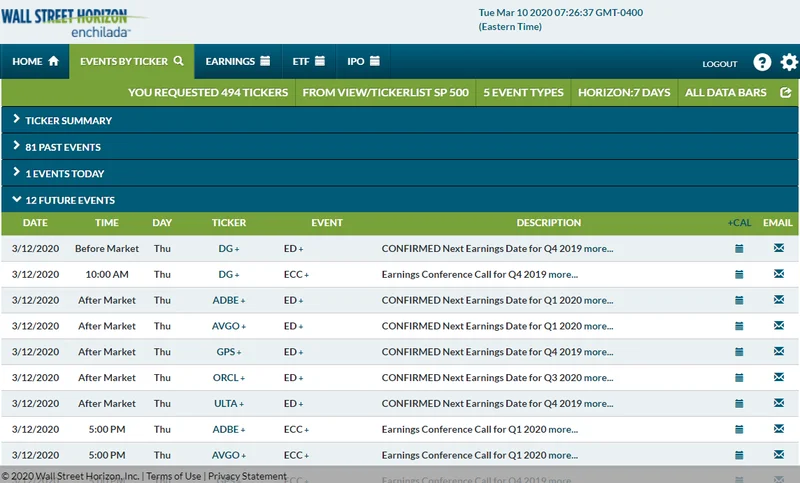

The stage is set for another week of market theater. As the calendar flips to the last week of October, all eyes, cameras, and algorithms will be fixed on the titans of tech. Microsoft, Meta, Apple, and Amazon are all slated to report, and the narrative is practically pre-written (Earnings Calendar and Analysis for This Week (October 27-31)). Pundits will dissect cloud growth percentages, scrutinize iPhone unit sales, and debate the metaverse's burn rate. It’s a familiar ritual, a high-stakes performance where multi-trillion-dollar companies tell us how the future is being built.

But if you want to understand the present, you need to look elsewhere.

While the market remains mesmerized by the choreographed pronouncements of Big Tech, the most vital, unvarnished truths about the U.S. economy won’t be found in a Cupertino keynote. They’ll be buried in the earnings calls of companies that deal in steel, washing machines, and garbage. My analysis suggests the real story this week lies not with the digital giants, but with the industrial bellwethers that form the economy’s physical foundation. The divergence between what these two groups report could be the most significant signal of the entire quarter.

This isn't about ignoring Apple or Amazon; their scale is undeniable. It's about recognizing that their performance has become a distorted lens through which we view economic health. They are like colossal ships that can glide for miles on sheer momentum, long after the ocean currents have changed. The smaller, more sensitive vessels—the ones that actually have to navigate the choppy, day-to-day waters of consumer sentiment and industrial demand—are the first to signal a storm. And this week, we get to check their logs.

The Unsexy Barometers of Reality

Let’s be clear: the companies that offer the purest signal are often the ones with the least exciting investor presentations. They don’t announce revolutionary AI models or sleek new consumer gadgets. Instead, they provide the essential, tangible goods and services that underpin everything else. I'm looking at three specific reports this Monday that will set the tone for my entire week of analysis: Waste Management (WM), Nucor (NUE), and Whirlpool (WHR).

Waste Management is perhaps the most elegant economic indicator there is. Its business is a direct proxy for commercial and industrial activity. When factories produce more, construction sites are active, and businesses expand, they generate more waste. It’s a simple, unglamorous correlation. Hearing the distant, early-morning rumble of a garbage truck isn’t just noise; it’s the sound of commerce. If Waste Management’s commercial volumes are down or its outlook is cautious, it tells you something fundamental about broad-based business activity that a rosy forecast for cloud services simply cannot.

Then there’s Nucor, the largest steel manufacturer in the United States. Steel is not an abstract concept; it is the literal backbone of the economy. It’s in the cars we drive, the buildings we work in, and the bridges we cross. Nucor’s order book and management commentary provide a direct read on everything from automotive manufacturing health to commercial real estate development. While the market obsesses over software margins, I’ll be listening for any discussion of tariffs, infrastructure spending, and, most importantly, forward demand from their major industrial clients. Is capital expenditure slowing down across their customer base? That’s a question far more critical to the S&P 500’s next six months than the App Store’s take rate.

And finally, we have Whirlpool. With a market cap of just over $4 billion (a rounding error for a company like Apple), its report could easily be overlooked. That would be a mistake. Appliance sales are a classic barometer of consumer health and the housing market. A refrigerator or a washing machine is a major durable good purchase, one that households don’t make if they feel uncertain about their financial future. A slowdown in this sector signals a retreat by the American consumer that will eventually ripple up the entire economic food chain. I’ve looked at hundreds of these filings, and the management commentary from a company like Whirlpool is often more revealing about household balance sheets than any government-issued sentiment survey.

The Widening Gyre

The core of my thesis is this: for the past few years, the mega-cap tech stocks have operated in an economy of their own, fueled by massive cash reserves, secular growth trends, and market dominance. This has created a dangerous divergence, where the stock market's performance, heavily weighted toward these few names, no longer reflects the reality experienced by most other businesses. This week offers a perfect test of that divergence.

It’s entirely possible that Apple will report fantastic iPhone sales and Microsoft will beat expectations on Azure growth, sending the Nasdaq soaring. But what if, on the same day, Nucor guides down due to weakening demand from automakers, and Whirlpool speaks of a cautious consumer? Which signal do you trust? The market has been conditioned to follow the tech narrative, to believe that software and services are all that matter.

This is like judging the health of a skyscraper by only looking at the penthouse suite. It might be beautiful, with incredible views, but if the foundation is cracking and the steel frame is under stress, the entire structure is at risk. Waste Management, Nucor, and Whirlpool are reports on the foundation.

The data itself presents its own challenges. Consensus EPS for Nucor is around $2.20—more precisely, the estimates I’ve seen range from $2.16 to $2.22 depending on the source aggregation method. This small discrepancy (a result of different analysts weighing factors differently) highlights the noise in forecasting. But the direction of the surprise and, more critically, the qualitative guidance from management will cut through that noise. That’s the data I’m waiting for.

The Data's Divergence

Ultimately, the headlines will belong to Tim Cook and Satya Nadella. The algorithms will trade the ticks on their revenue beats or misses. But the intelligent capital should be focused on the less glamorous data points. The real risk this week isn't that Meta's ad revenue comes in 2% below expectations. The real risk is that the foundational economy—the one that moves physical goods, pours concrete, and responds to the financial health of the average household—is flashing warning signs that the market, in its tech-obsessed euphoria, is choosing to ignore. The story is not what the tech giants say; it's whether the rest of the economy is still listening.