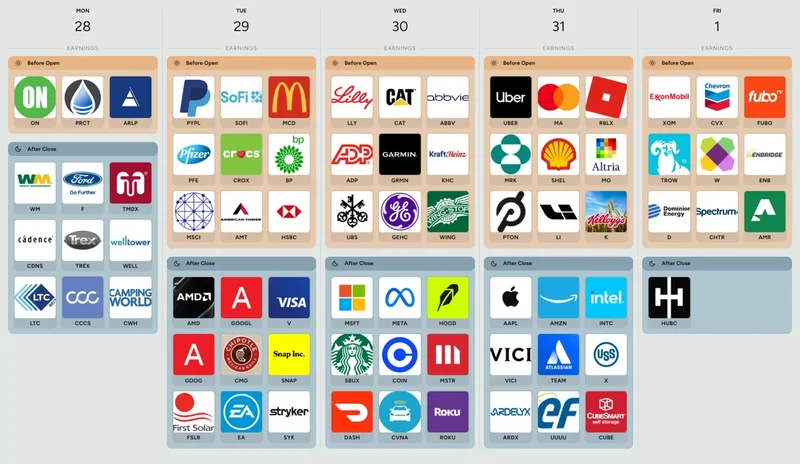

It started with a simple, almost trivial task. I was pulling up the latest numbers—you know the drill, the quarterly dance of `tesla earnings`, `google earnings`, and `meta earnings today`. I was hunting for the data, the raw signals that supposedly tell us how the world is turning. And then, I hit a wall. Not a paywall, not a 404. Something far more... poetic.

A stark white screen with black text: "Access to this page has been denied."

The reason? "Because we believe you are using automation tools to browse the website."

I just stared at it. Me? An automation tool? I was just a guy with a coffee, a keyboard, and a question. But the machine, the gatekeeper of the very information I sought, had flagged me as one of its own. When I first saw the message, I honestly just sat back in my chair and laughed. The irony was so thick you could cut it with a knife. In a world where high-frequency trading bots execute millions of transactions in the blink of an eye, where AI models parse every `earnings today stock market` report before a human analyst even gets their second cup of coffee, the system had become so paranoid about its own reflection that it was now locking the doors on its creators.

This isn't a bug. It's a prophecy. That sterile error message is the clearest sign yet that the entire framework we use to measure value and progress is breaking down. We’re trying to access the future with a browser built for the past, and the server is finally telling us our credentials have expired.

The Ghost in the Financial Machine

Let's really think about that error message. The system suspects automation. It’s looking for bots. But what is the modern stock market if not the world's most complex and consequential automation tool? From the moment `microsoft earnings today` are announced, algorithms—not people—are performing the initial analysis, driving the initial price movements. The entire system is a ceaseless, automated conversation about value.

Accusing a human of using "automation tools" to access this ecosystem is like an ocean wave getting angry at a single drop of water for being wet. It's a sign of a system so saturated with its own logic that it can no longer recognize its origin point. We are building a new digital reality, a financial world that operates at a speed and complexity that is fundamentally non-human. This is a fundamental re-evaluation of everything we thought we knew about corporate value, a shift from tangible assets and quarterly profits to intangible data flows and predictive power and it’s happening so fast the old systems are literally throwing up error messages trying to keep up.

This leads to a profound question, one that goes far beyond the `earnings calendar`. What happens when the tools we build to understand the world become so advanced that they preclude our understanding? Are we creating a new kind of financial priesthood, where only the keepers of the most sophisticated algorithms can truly "read" the market, while the rest of us are left staring at an "Access Denied" page, locked out of the very system that shapes our lives?

Measuring a Rainbow with a Ruler

The real story isn't about the Q3 profits for `amazon earnings` or the subscription growth for `nflx stock`. That's the old news, the lagging indicator. The reason our old tools are failing is that they are trying to measure the wrong thing. We’re still obsessed with the financial "earnings" of tech giants, when their true output is something far more significant.

The real, game-changing "product" from Google, Meta, and Microsoft isn't a search result, a social feed, or a software license. It's the creation of vast, learning intelligences. The value is in their latent computational potential—in simpler terms, it’s about what their massive, interconnected systems could do tomorrow, not just what they sold today. Trying to value a company like Tesla based solely on car deliveries and profit margins is like trying to measure the historical impact of the printing press by counting the number of Bibles it sold in its first year. You're dutifully counting the pages while completely missing the fact that it's about to ignite the Renaissance, the Reformation, and the entire modern age of information. You’re measuring the immediate output, not the paradigm shift.

Imagine trying to explain the value of the internet to a 1980s stockbroker. You'd talk about connecting every library, every school, every human mind. They'd ask you for the quarterly earnings report and the price-to-earnings ratio. You'd be speaking different languages. That's where we are right now. We are standing at the dawn of a new era, one defined by artificial intelligence and global data networks, and we're still trying to measure it with the intellectual equivalent of an abacus.

Of course, with this incredible power comes an equally incredible responsibility. As we build this new world, one where value is more abstract and power is concentrated in the hands of those who control the data and the AI, we have to ask the hard questions. How do we ensure this future is equitable? How do we prevent a new kind of digital feudalism where access to opportunity is dictated by an algorithm? The challenge isn't just technological; it's deeply human. We have to build the ethics for this new world at the same time we're building the technology.

The Access Code is a New Perspective

That error page wasn't a barrier. It was an invitation. It was the digital ghost in the machine, tapping us on the shoulder and whispering that the old map no longer represents the territory. The frustration of being denied access is the very feeling that will push us to create a new way in.

We can't keep asking the same old questions. "What companies report earnings today?" is becoming irrelevant. The real question is, "What companies are building tomorrow today?" The true `google stock` value isn't a number on a screen; it's the potential locked inside its global network to solve problems we once thought were unsolvable. The real story of `meta` isn't its ad revenue, but its research into new forms of human connection.

The "Access Denied" message isn't a dead end. It’s a signpost pointing us toward a more profound, more exciting, and frankly, more important way of seeing the world. The future isn't locked. We just need to stop rattling the old doorknob and start building a new key.