So, let me get this straight. The big question buzzing around the financial web last week was, "Should You Buy Eli Lilly Stock Before Oct. 30?" As if anyone with a keyboard and an internet connection has a crystal ball. It’s the kind of clickbait headline that preys on the worst instincts of every retail investor—the fear of missing out, the itch to time the market perfectly, the fantasy of nailing that one big score.

It’s a fool’s game. And now that the dust has settled and Lilly apparently blew the doors off its Q3 earnings—with headlines declaring Eli Lilly blows past estimates, hikes guidance as Zepbound and Mounjaro sales soar—everyone who advised caution looks like an idiot, and every lucky gambler is patting themselves on the back. But let's be real: it was a coin flip. A high-stakes, pharma-fueled coin flip. Anyone who tells you they knew what was going to happen is either a liar or a time traveler.

The whole spectacle is exhausting. The pre-game show where analysts throw out numbers, the post-game analysis where they explain why their numbers were wrong but their 'thesis' was right... it's all just noise designed to make you feel like you need to do something.

The Wall Street Guessing Game is a Joke

Before the big reveal, Wall Street’s finest were predicting Lilly would pull in about $16 billion in revenue. Sounds precise, right? But when it came to earnings per share, their "expert consensus" was all over the map. The average guess was $5.92, but the range stretched from a gloomy $5.49 all the way to a euphoric $7.21.

That isn't analysis; that’s throwing darts at a board in a dark room. A nearly two-dollar spread on a single share's earnings is basically an admission that they have no earthly idea what’s going on. It’s like a weather forecast predicting the temperature will be somewhere between a brisk autumn day and the surface of the sun. Thanks for the insight, guys.

And offcourse, it all comes down to two blockbuster drugs, Mounjaro and Zepbound, which make up more than half the company's revenue. We all knew those drugs were selling like hotcakes. The analysts’ job was to figure out how many hotcakes, and they couldn’t even agree on that. It's the ultimate irony: the most predictable part of Lilly's business was still a complete mystery to the so-called experts. So what are these people even getting paid for? To state the obvious and then hedge their bets so aggressively they can’t possibly be wrong?

The Market Has Lost Its Mind

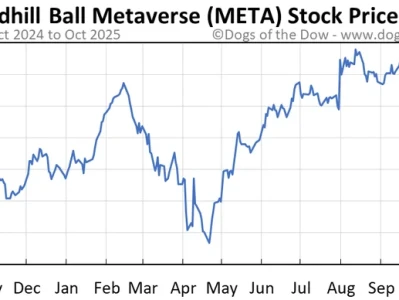

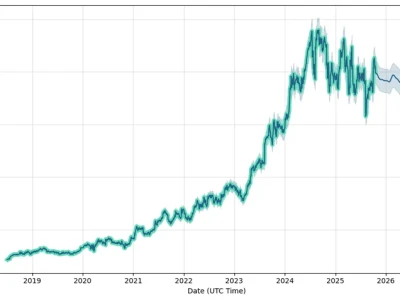

Here’s where it gets truly bizarre. Even if you had perfectly predicted Lilly’s numbers, it wouldn’t have mattered. The stock market, in its infinite wisdom, has apparently decided that fundamentals are optional. Just look at Lilly’s track record over the past year.

On February 6, they beat earnings estimates by 5%. The stock barely budged.

On May 1, they missed earnings by almost 6%. Did the stock tank? Nope. It went up.

Then on August 7, they crushed estimates by nearly 13%. A rocket ship to the moon, surely? Wrong again. The stock dipped.

This is just random. No, 'random' doesn't cover it—this is a five-alarm dumpster fire of irrationality. The only time the stock actually behaved "logically" was a year ago, when it fell after a big miss. One out of four. You’d get better odds in Vegas.

It’s like the entire market is a toddler throwing a tantrum. You hand it a cookie (a great earnings report), and it throws the cookie on the floor. You tell it no (a miss), and it laughs and asks for more. There’s no logic, no reason, just pure, chaotic emotion. What is actually driving these prices day-to-day? Is it just algorithms scraping headlines for keywords? Are a handful of mega-funds just pushing billions around to see who flinches first? Because it sure as hell ain't based on the numbers in a quarterly report. And the financial media just keeps playing along, pretending any of this makes sense...

So We're All Just Gambling, Then?

Let's call this what it is. Asking whether you should buy a stock a day before earnings isn't investing, it's betting on red or black. The actual performance of the company has become a sideshow. The main event is guessing how a bunch of hyperactive trading bots and emotionally unstable fund managers will react to the news. The house always wins, and the house, in this case, is the market's sheer, unpredictable insanity. If you want to invest in Lilly, fine. Look at their 10-year plan. But for God's sake, stop treating earnings day like the Super Bowl. It's just another spin of the roulette wheel.