Trump's 2026 Tax "Gift": A Mirage Built on Debt?

The Illusion of a Windfall

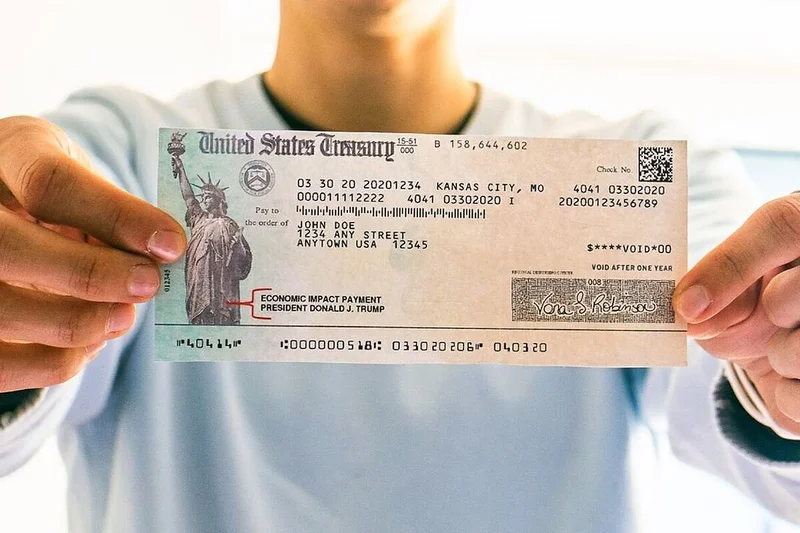

So, we're staring down the barrel of potential tax refund increases in 2026, thanks to the retroactive application of Trump's One Big Beautiful Bill Act (OBBBA). JPMorgan's David Kelly is estimating an average refund of roughly $3,743. That's a jump from the IRS's reported $3,186 the previous year. Sounds great, right? Another $557 in your pocket.

But let's not pop the champagne just yet.

Kelly himself is waving a red flag, pointing out that this isn't a uniformly distributed benefit. Tax deductions, as anyone who's crunched the numbers knows, disproportionately favor those in higher tax brackets—up to the point where those deductions phase out, of course. We're talking about specific groups benefiting from very specific provisions within the OBBBA. A $6,000 deduction for those 65 and over, for example, phases out above $175,000 (single) or $250,000 (joint). Qualified tip deductions? Gone if you're pulling in over $150,000 ($300,000 joint). The Child Tax Credit gets a bump to $2,200, adjusted for inflation.

Here's where I start to raise an eyebrow.

The IRS isn't adjusting withholding rates in 2025. That means we're all overpaying our taxes throughout the year, only to get a chunk of it back later. It's like being forced to give the government an interest-free loan. And this is the part of the report that I find genuinely puzzling. Why frontload the pain and delay the (illusory) gain?

The Unintended Consequences

The Democrats are already circling, pushing to claw back some of the health care and social benefits cuts baked into the OBBBA. And let's be honest, a government shutdown (which, incidentally, just happened on October 1, 2025) doesn't exactly inspire confidence in fiscal stability.

What happens when people realize this "refund" isn't free money? It's their money, returned without interest, after the government has had a year to play with it. Will they adjust their spending habits down in 2025 to compensate? Will they save the refund in 2026, or will it just fuel a temporary spike in consumer spending?

The OBBBA is a sprawling piece of legislation, containing hundreds of provisions. It’s easy to get lost in the weeds. (The bill probably has more words than this entire article.) But focusing on this refund bump misses the bigger picture. It's a symptom, not a cure. A sugar rush before the crash.

I've looked at hundreds of these filings, and this particular situation is unusual. The confluence of retroactive tax cuts, unchanged withholding rates, and looming government shutdowns creates a perfect storm of economic uncertainty. It's a shell game, where the illusion of prosperity masks a deeper fiscal problem.

A Shiny Nickel, Tarnished by Debt

The $3,743 refund is a mirage. It's borrowed money, repackaged and returned with a smile. The real question is: what's the long-term cost of this political sleight of hand?