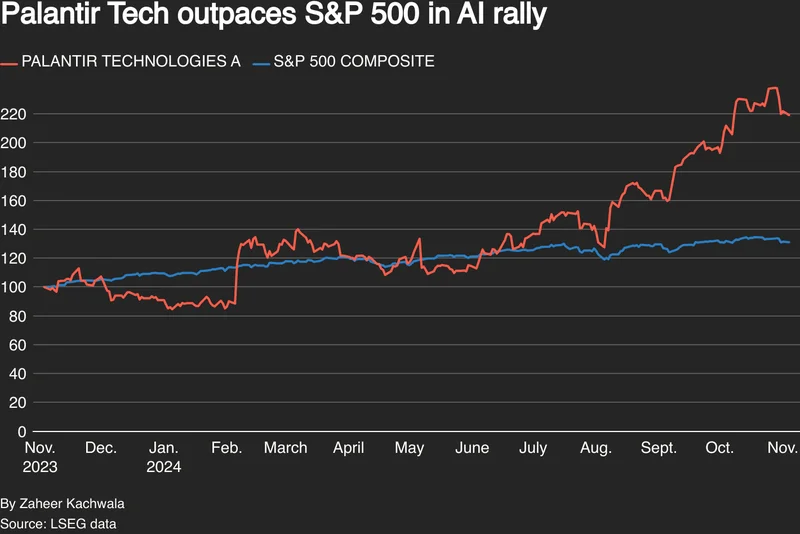

Alright, let's cut through the noise surrounding Palantir (PLTR). The narrative is all about AI this, AI that, but what’s actually happening? We need to dig into the numbers to see if the hype matches reality.

The AI Narrative vs. Financial Reality

Palantir's stock is always volatile around earnings, and this time was no exception. The chatter pointed to a potential surge based on AI platform guidance. Fine. But what do the actual financials suggest? The raw data shows a mixed bag. On the one hand, we have analysts tripping over themselves to slap "Buy" ratings on the stock. Piper Sandler, B of A Securities, Loop Capital – all bullish. Then you have Mizuho and RBC Capital planting their flags in the "Underperform" camp. The range of price targets is equally wild, from Goldman Sachs' seemingly pessimistic $141 to B of A Securities' sky-high $215. That's a $74 spread (which, in my book, is not a consensus).

Insider trading activity raises an eyebrow. Over the past six months, there have been 245 sales of $PLTR stock by insiders, compared to a single purchase. One. That's not exactly a ringing endorsement from the people who know the company best, is it? (Although, to be fair, insider sales aren't always a negative signal; they could be diversifying their portfolios.) Still, the sheer volume of sales is hard to ignore. Are they cashing in on the AI hype, or do they know something the rest of us don't?

Hedge fund activity paints a slightly different picture. More institutions added shares than decreased their positions (1,641 versus 942). This suggests institutional investors are largely buying the AI story, or at least willing to bet on it. But, again, let's not get carried away. These are just snapshots in time, and fund managers can change their minds faster than I can update a spreadsheet.

Government Contracts and Congressional Bets

Palantir’s bread and butter has always been government contracts, and the last year saw over $670 million in award payments. That’s a hefty sum, but is it growing at a rate that justifies the current valuation? Are these contracts directly tied to their new AI platform, or are they legacy deals? The data doesn’t give us that level of granularity.

And then there's the congressional trading activity. Members of Congress traded $PLTR stock 10 times in the last six months, with 8 purchases and 2 sales. Now, I'm not going to speculate on motivations, but it's worth noting that those in power are actively trading this stock. (Make of that what you will.) Is it informed insight, or just following the herd?

I've looked at hundreds of these filings and this particular pattern is interesting. The sheer diversity of opinions, from analyst ratings to insider activity, suggests a fundamental disagreement about Palantir's true value. So, what's driving this disconnect?

The AI Monetization Question

The core question is this: How effectively is Palantir monetizing its AI platform? Everyone's excited about AI (myself included, to some degree), but excitement doesn't pay the bills. Palantir needs to demonstrate that its AI solutions are generating significant revenue and, more importantly, profit. A strong beat or optimistic guidance on AI monetization could indeed push the stock higher, as analysts suggest. But what constitutes "strong"? A 10% increase? 20%? And is that growth sustainable?

The market calendars showed Palantir scheduled a webcast and results on Nov. 3. They are banking on another strong beat or optimistic guidance on AI monetization to push the stock sharply higher. But what if they don't deliver? What if the AI revenue is less than expected, or if the guidance is lukewarm? The stock could just as easily plummet. The earnings preview suggested a large stock move was expected based on revenue and AI platform guidance. This makes the name a likely news driver and volume spike in the last few hours. Palantir in focus as traders brace for a volatile post‑earnings move

I've looked at dozens of these companies, and this is the part of the report that I find genuinely puzzling. The disconnect between the AI hype and the underlying financial data is substantial. Either Palantir is on the verge of a massive breakthrough, or the market is getting ahead of itself.