Generated Title: Burry Bets Big Against Palantir: Genius Move or Epic Fail?

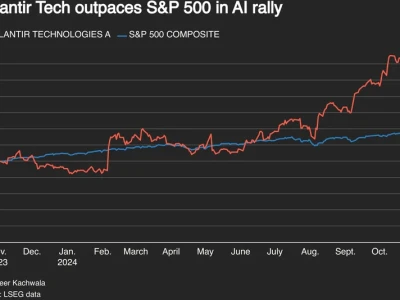

Michael Burry, the man who famously predicted the 2008 housing crisis, is making waves again. This time, he's placed a massive bet against Palantir, a company riding high on the AI wave. Is he a visionary seeing a correction coming, or is he missing the boat on a genuine tech revolution? Let's dive into the numbers and see if Burry’s bearish stance on Palantir holds water.

Burry's Scion Asset Management scooped up five million put options on Palantir. That's not pocket change; Whale Wisdom estimates the market value of these puts at $912.1 million. He's also shorting Nvidia with another million put options. Adding fuel to the fire, Burry posted on X (formerly Twitter) hinting at an AI bubble, even dropping a Star Wars reference: "These aren't the charts you are looking for." Cryptic, sure, but the message is clear: he's not buying the AI hype. Michael Burry Is Super-Bearish On Palantir — With 5 Million Puts - Palantir Technologies (NASDAQ:PLTR)

Palantir's Q3 Performance: A Closer Look

Palantir's recent Q3 earnings report paints a different picture. They reported earnings per share of $0.21, exceeding the consensus estimate of $0.17. Revenue hit $1.18 billion, also surpassing expectations of $1.09 billion. Sales jumped 63% year-over-year, fueled by a staggering 121% increase in U.S. commercial revenue and a solid 52% growth in U.S. government revenue. The company also raised its full-year revenue outlook to between $4.396 billion and $4.40 billion, up from the previous forecast of $4.142 billion to $4.15 billion. So, what gives? How can Burry be so bearish when Palantir seems to be firing on all cylinders?

The key, I suspect, lies in the sustainability of this growth. Palantir is touting the rising adoption of its Artificial Intelligence Platform (AIP). But is this adoption driven by genuine need and long-term value, or is it fueled by the current AI frenzy? Contract value is through the roof: a record $2.76 billion in total contract value (TCV), up 151% from the prior year. U.S. commercial TCV is up an even more impressive 342% year-over-year, reaching $1.31 billion. Remaining deal value (RDV) in U.S. commercial hit $3.63 billion, up 199% year-over-year. Those are eye-popping numbers, no doubt. But are they too good to be true?

I've looked at hundreds of these filings, and this particular surge in commercial TCV raises an eyebrow. It's like a hockey stick growth curve – unsustainable in the long run. While the earnings numbers look good now, the market is forward-looking. The question isn't just whether Palantir is doing well now, but whether it can maintain this trajectory. If growth slows even slightly, the stock could take a serious hit. And this is the part of the report that I find genuinely puzzling: How much of this growth is based on short-term contracts and hype versus long-term, sticky customer relationships?

Burry's other moves are also telling. He increased his stake in Lululemon, Molina Healthcare, and SLM Corp. He also bought calls on Halliburton and Pfizer, indicating a belief in more traditional sectors. At the same time, he closed his positions in Estee Lauder, Regeneron, MercadoLibre, and UnitedHealth Group. It's a clear shift away from high-growth tech and towards more stable, value-oriented investments. This isn't just a bet against Palantir; it's a broader bet against the current market euphoria.

The AI Bubble and Echoes of the Past

Burry's X post comparing the current AI boom to the 1999-2000 tech bubble is particularly relevant. He posted charts showing AI capex mirroring the tech spending of that era. The analogy is compelling. During the dot-com bubble, companies were throwing money at anything with ".com" in the name, regardless of its actual value. Are we seeing a similar dynamic with AI? Are companies investing in AI solutions simply because they feel they have to, not because it's actually the most efficient or effective way to solve their problems?

Palantir forecasts U.S. commercial revenue of more than $1.433 billion, up at least 104% year-over-year. Adjusted income from operations is projected between $2.151 billion and $2.155 billion, with adjusted free cash flow expected to range from $1.9 billion to $2.1 billion. Again, impressive numbers. But the market has priced in perfection for Palantir. Any slip-up, any sign of slowing growth, and the stock could plummet. PLTR Earnings: Palantir Stock Pops after Strong Q3 Results, Lifts Outlook

Is Palantir Overvalued?

Wall Street analysts seem divided. PLTR stock has a Hold consensus rating based on four Buys, 13 Holds, and two Sells assigned in the last three months. The average Palantir stock price target is $154.88, implying a 25.05% downside risk. Now, analysts may update their price targets after this earnings report, but the fact remains: there's significant disagreement about Palantir's true value. The stock popped about 2% in after-hours trading following the earnings release. But that's a relatively muted reaction, suggesting that the market isn't completely convinced.

A Genius Move or a Miscalculation?

So, is Burry right? Is Palantir a ticking time bomb, ready to explode when the AI bubble bursts? Or is he missing out on a genuine technological breakthrough? It's impossible to say for sure. But one thing is clear: Burry is betting that the market's enthusiasm for Palantir is overblown. He's betting that the company's growth is unsustainable, and that the stock is significantly overvalued. And given his track record, it's a bet worth taking seriously.

All Hype, No Substance?

Burry's bet isn't just about Palantir; it's a commentary on the broader market environment. It's a reminder that even in the midst of a technological revolution, fundamentals still matter. And sometimes, the smartest move is to bet against the crowd.